camera to download

Super easy and fun to use.

How it works?

-

Set Your Savings Goals

Define what you're saving for, whether it's a big trip, a new home, or clearing debt. We help you set realistic, achievable goals that keep you motivated.

-

Link Your Accounts

Securely connect your bank accounts and credit cards in just a few taps. Bigmo will then use your account information to create a personalised spending plan in under 5 mins.

-

Create a Spending Plan

Build a personalized spending plan that aligns with your income, fixed expenses and savings goals. Know exactly how much you can spend each month in order to meet your savings goals.

-

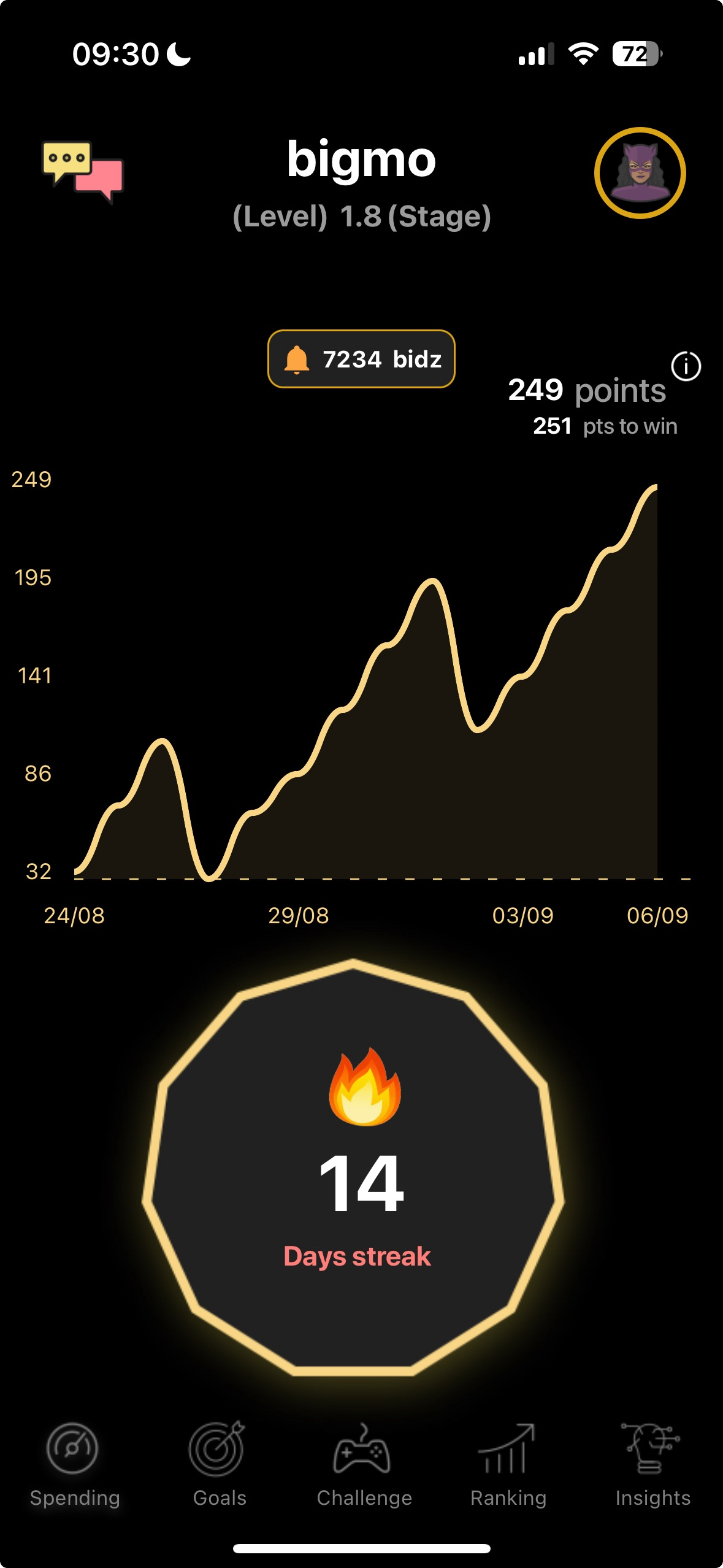

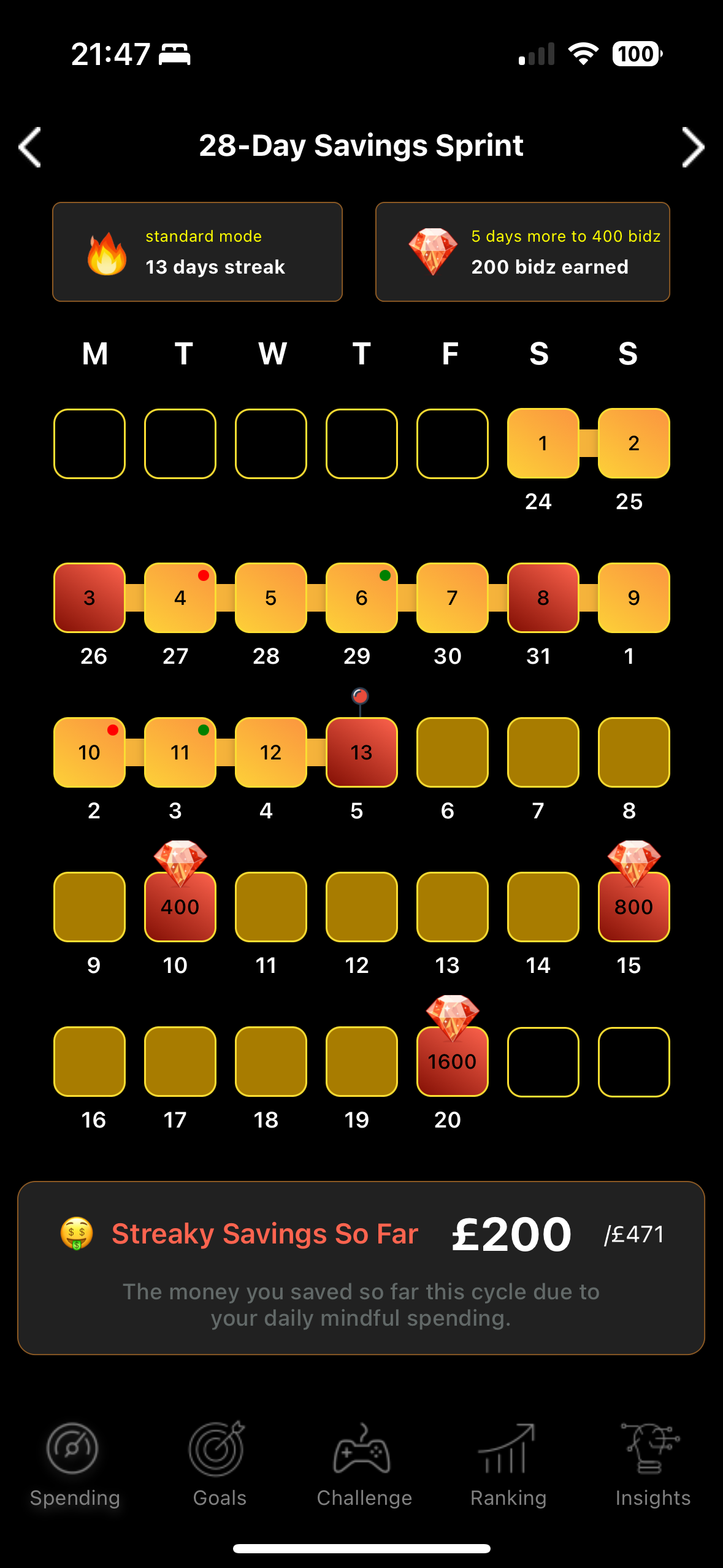

28-Day Savings Sprint

Take on our unique 28-day challenge to improve your spending habits. Build streaks, visualise progress and earn "bidz" for hitting your goals, keeping you motivated, engaged and accountable.

-

Earn Rewards

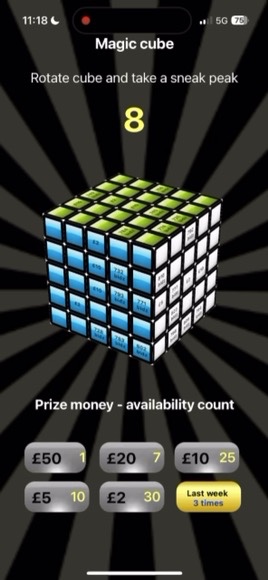

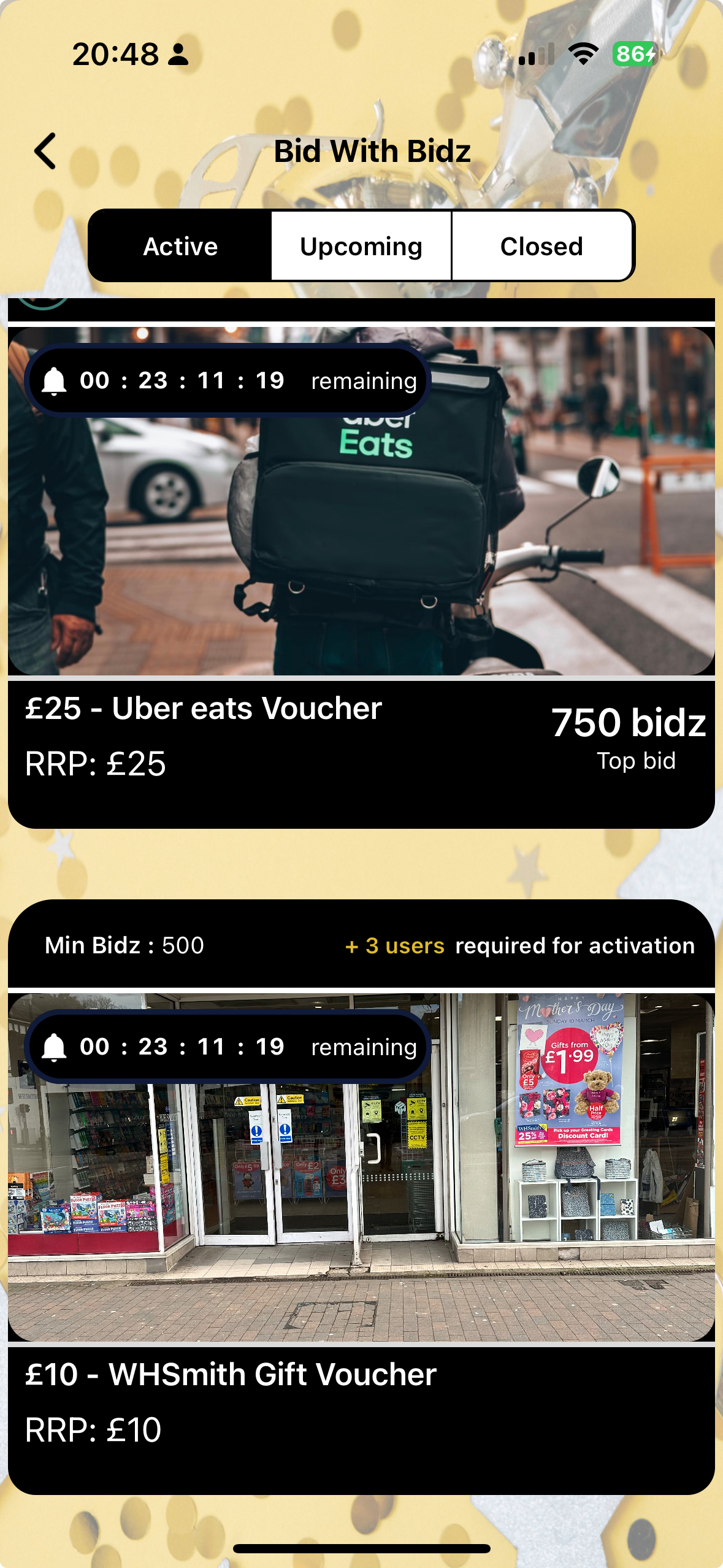

Reach savings milestones and collect bidz as you go. Use bidz to enter auctions for chances to win real prizes. And there is a mini game for more rewards, when you hit weekly milestones.

-

Get the Big Picture

See all your finances in one place, from spending to savings and progress toward goals. Track how close you are to reaching your goals, get insights/nudges and make adjustments as needed.

Power-packed with features

- 28-Day Savings Sprint

- Streaks

- Games

- Rewards

- Spending Insights

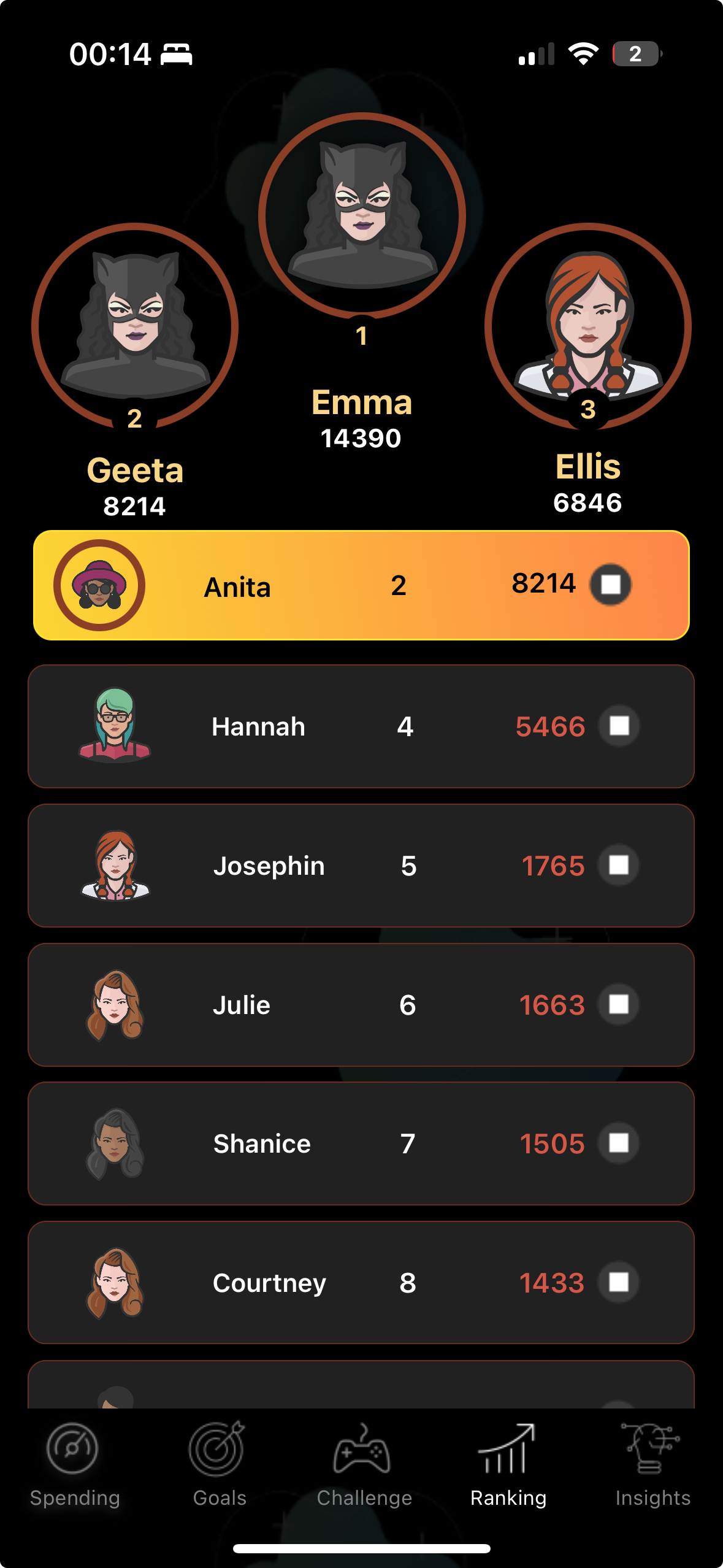

- Leaderboards

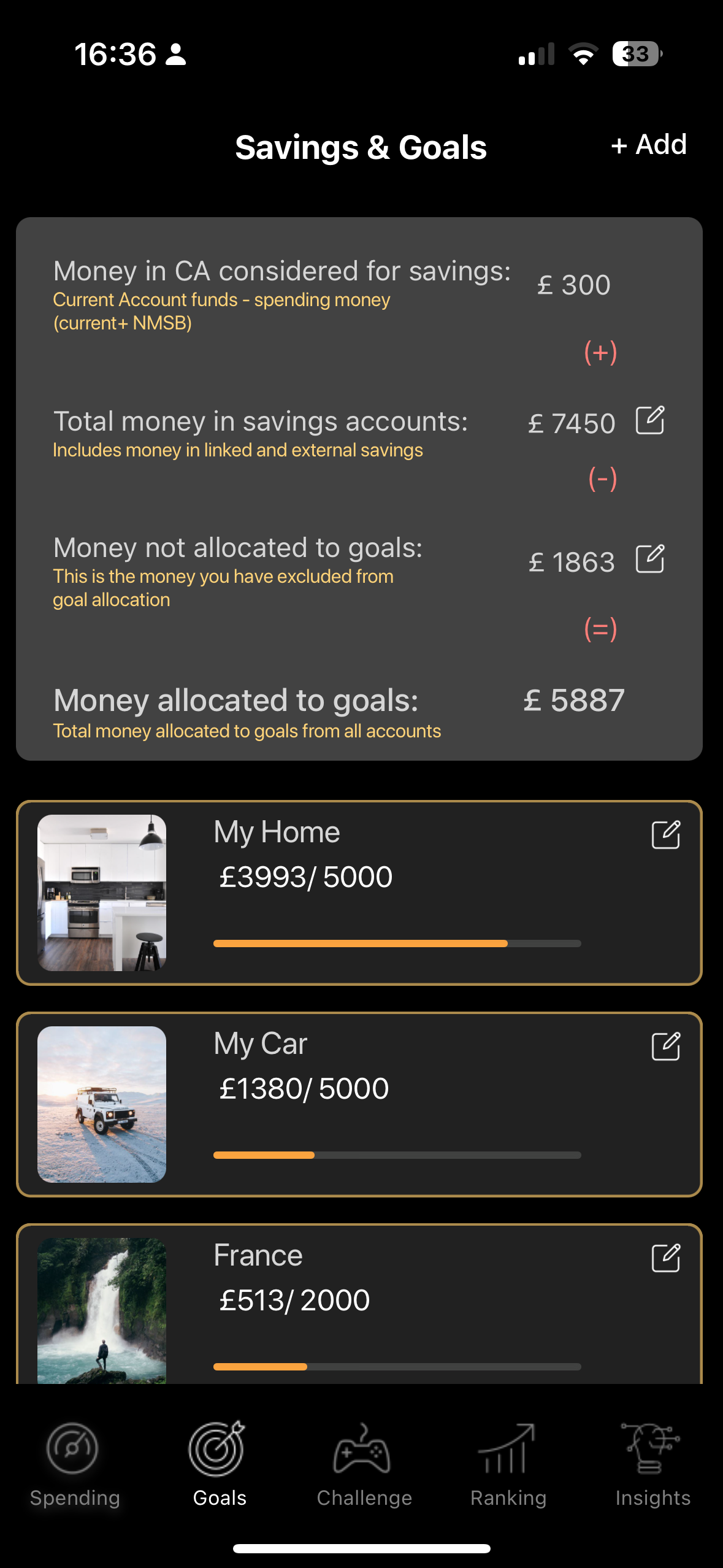

- Goal Tracking

We live in a world that constantly pushes us to spend without thinking. Join Bigmo's 28-Day Savings Sprint to take control of your money and stay accountable.

Stay on track with your savings goals by building streaks. The longer you stick to your plan without overspending, the more rewards you unlock!

Prize-winning games to influence your decisions. Stick to your goals to qualify and get rewarded.

Use the bidz you’ve earned to enter auctions and compete for exciting prizes. The more you save, the more chances you get to win big!

** All rewards are subject to availability

Get personalized tips and insights based on your spending habits. These smart suggestions help you make better financial decisions and stay on track with your goals.

Relative performance to fuel your momentum and challenge yourself further.

Easily track your progress toward your savings goals in one place. Bigmo helps you see how close you are and keeps you motivated to reach each milestone.

Link your accounts & get the bigger picture

Big Picture Labs Ltd is an agent of Plaid Financial Ltd., an authorised payment institution regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 (Firm Reference Number: 804718). Plaid provides you with regulated account information services through Big Picture Labs Ltd as its agent.

Frequently Asked Questions

- About

- How does it work?

- Cost

- Rewards

- Security

-

What is the Bigmo vision

Our vision is to enable our users reach their big moments in life, without compromising on the lighter moments that matter.

-

How do I contribute / collaborate / invest?

Please write to Prasanna@bigpicturelabs.co.uk. You could also try our business Whatsapp

-

How do I ask more questions?

Please use our chat facility(bottom right) on this website. You could also try our business Whatsapp

-

I’ve tried a couple of money apps. What is unique about bigmo?

Bigmo turns saving into a fun and engaging challenge. Unlike other apps, Bigmo helps you stay motivated with rewards, streaks, and personalized tips to keep you on track. It's not just about tracking your spending—it's about hitting your goals faster while enjoying the process.

-

Can you give a quick intro on bigmo?

Saving money is hard, boring and takes ages. No wonder 1 in 4 UK adults have less than £100 in savings. Bigmo (Short for Big moments) is on a mission to help users save more for their big moments in life. As a user you set goals, link your accounts and participate in a gamified competitive mission to fulfil your goals, where you compete with peers to achieve your goals. Each week as you are disciplined with your spending, you earn bidz which is our in-app virtual currency, participate in weekly mini games and live auctions to win exciting rewards every single week. The rewards get better the better you perform.

-

How does bigmo measure my discipline?

You give consent to link your bank accounts securely with bigmo to allow read only access for bigmo. We track your spending and our algorithms work out how well you are performing with respect to your monthly goals.

-

Can I change my goals and targets after I’ve entered a monthly challenge?

You could change your goals and targets, after you had entered a monthly challenge but that will be reflected in the next month challenge. Like any other challenge you can’t change the rules of the game after the challenge has started - sounds fair?

-

How does bigmo encourage me to save?

Bigmo encourages you to save by turning it into a 28-day challenge with streaks, rewards, and penalties. You earn bidz for hitting milestones, which you can use in auctions for real prizes. However, if you overspend, you face penalties that motivate you to stick to your budget. Plus, you'll receive personalized tips and insights to help you stay on track and motivated throughout your savings journey.

-

What are the eligibility rules to use bigmo?

There are a couple of rules that are in place to make it fair for all: 1. You are expected to save a minimum of £150 a month and 50% of your discretionary spending allowance(money left out of your income after paying your mandatory expenses/bills). We have a buffer of £100 included. If your income and fixed expenses allows you to have a discretionary spending allowance of less than £400, then unfortunately you’d not be able to participate in bigmo.

2. You must link your income account to prove that you earn a monthly recurring income to be able to spend and save out of your income. At the moment, bigmo has a lower income threshold of £700/month. If your income falls below that threshold, you wouldn’t be able to participate.

You can easily check if you are eligible before you link your accounts. -

What are bidz?

Bidz is the in-app virtual currency used within bigmo and rewarded to you primarily when you reach certain streak milestones within the 28-Day savings sprint. Bidz don’t have any monetary value inside or outside of bigmo. Bidz is a measure of your financial resilience and can be used to bid in auctions to win exciting rewards.

-

If I am not comfortable with bigmo, Can I opt-out?

For some reasons you decide it’s not working you can delete and opt out of bigmo anytime. Deleting will also disconnect from your bank accounts

-

Do I need to pay to use bigmo now?

You can start using Bigmo free for 2 months. After that our standard tier pricing starts at £5.99/mo, paid monthly. Annual package is available at 25% discount.

-

Give me 5 reasons why my £5.99 a month for Bigmo is worth it?

1. You are expected to save a £150+ each month after taking up the Bigmo challenge. Even if you save an extra £50, you have actually paid for the yearly subscription through that saving.

2. Bigmo is not the ordinary passive money tracking app. It is designed from the ground up to offer the motivation and accountability to help you achieve your budget through 28 day recurring savings sprint, low spend challenge, rewards and motivating penalties.

3. You get to create a personalised spending plan aligned to your savings goals. Budgeting 101 done right for the first time.

4. Comprehensive spending insights and analytics on your linked bank accounts and credit cards- you get crystal clear insights within 10 mins of onboarding - get ready for a suprise.

5. Get your savings and goals linked for the first time across bank accounts - current and savings (linked and manual).

Plus No Ads. No selling of data. No marketing messages to upsell. Quick support through chat and Whatsapp -

Is there a free tier?

You get all features free to access for 2 months. If Bigmo works for you, you could continue using bigmo. Else you could cancel it any time during the 2 months and you won't be charged.

Building and running apps in this space requires significant costs - apps in this space sell up to £13/mo. We believe in a simple pricing model. No gimmicks offering a trivial free tier to push people to paid tier.

-

What are the different types of rewards?

Bigmo offers different types of rewards - virtual currencies, cash and experiences based on availability

-

Are rewards guaranteed if I perform?

Virtual currencies are guaranteed based on performance. However cash and other rewards are subject to availability and are not guaranteed.

-

Is Bigmo secure?

bigmo is regulated by FCA(Financial conduct authority). We use secure Open banking technology, recommended and trusted by banks. We ensure bank grade security and your security and privacy wouldn’t be compromised at the cost of running the business.

-

Are my savings safe?

Any money you save stays in your existing bank or building society accounts. Bigmo can't or won't move any money outside.

-

Can’t some users game the system?

Bigmo has rules inbuilt to spot such cases. By integrating with users bank accounts and analysing their financial position, we can spot people trying to game the system. Such users will have a low chance of entering the challenge and also a low chance of winning rewards. This way the system remains fair for all.